GREEN TAX: Daily Current Affairs

- In order to curb the pollution and motivate people to switch to environmental alternatives, the road transport ministry has announced very recently to impose additional taxes on vehicles. It will be known as the Green tax.

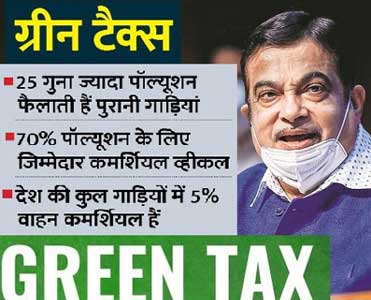

- The Union Minister for Road Transport and high ways – Nitin Gadkari, recently approved the proposal to levy a green tax on vehicles.

- This green tax will be levied on old vehicles. The owners of old vehicles will have to pay the tax as a penalty for polluting the environment.

- This will be higher if you are residing in one of the polluted cities in India.

- A GREEN TAX is a pollution tax or environmental tax.

- It is an excise duty on the activities or good that cause environmental pollution.

- This taxation method discourages people and makes them more responsible and sensitive towards the environment.

- According to the ministry, a Green tax will reduce the pollution level, and make the polluter pay for pollution.

- It will also prevent people from using vehicles that are old and damaged. Moreover, it will motivate them to switch to environmentally friendly alternatives.

- Under the Green tax, Personal vehicles will be charged a tax at the time of renewal of registration certificate after 15 years.

- The charges will vary depending on the type of fuel (petrol/diesel) as well as on the type of vehicle.

- Transport vehicles older than eight years could be charged with green tax at the time of renewal of fitness certificate at the rate of 10 to 25% of road tax.

- The Green tax also includes a steep penalty of up to 50% of road tax for older vehicles registered in some of the highly polluted cities.

- Public transport vehicles, like city buses, will be paying lower Green Tax, meanwhile, vehicles used in farming, such as tractors, harvester, tiller, etc will be exempted entirely.

- Approval for deregistration and scrapping of vehicles owned by the Government department and PSU that piled on the road for 15 years or more was also given.

- This will come into effect from April 1, 2022.

- The revenue collected from the green tax will be kept in a separate account and will be used for tackling pollution.

- The states have been asked to set up a state of the art facilities to monitor emissions.

- The main purpose of the green tax is to sensitize the citizens towards ever-increasing pollution and its harmful effects.

- As a responsible citizen, one should be conscious of protecting the environment.

- Maintaining and getting your vehicle serviced on time and discarding them responsibly after a designated period can help in protecting the environment in the long-run.